The payment card market is booming. According to Equifax Canada, average monthly credit card spending increased by 17.5% year-on-year in the first quarter of 2022, new card volume grew by 31.2%, and average credit limits granted to new cardholders reached an average of $5,500, the highest in seven years.

Eight out of ten consumers (78%) choose cards with a rewards program (source: Ratehub Report on digital currency trends in 2021). Rewards, the Holy Grail of customer loyalty, come in many forms: cash back, in-store credit, travel cards. Consumers are looking for value that goes beyond redeeming points in the same loyalty program where they acquired them. They want the freedom to choose how they earn their loyalty points and how they redeem them.“Today, the systems that generate these points need to have a high degree of personalization, greater flexibility around exchange possibilities and deadlines. Banks are lagging behind.

In the credit debit card space, marketing has always been the mainstay of issuer growth. Attracting new customers and identifying stimuli that increase the purchase of active customers remain at the forefront.

Traditional marketing campaigns by card issuers are often segmented according to “generic” variables around purchase history: recency, frequency, monetary value.

This method is a thing of the past.

Banks need to define individualized offers based on other variables that generate new revenue opportunities and monetize transactional data.

” Banks need to define individualized offers… that generate new opportunities to monetize transactional data.”

Mobi724 Global Solutions, a company offering services for sending promotional offers associated with payment cards, is always at the forefront of practices, and seeks to ensure that its banking customers benefit from the latest advances in artificial intelligence. It called on CRIM to define an innovative approach to individualized offers.

The objective is to infer one of two scenarios:

- the probability that consumer A will be more inclined than consumer B to buy a given product, say a car, as part of a promotional campaign.

- the probability that consumer A will buy a product in a new category that he/she has never bought before, based on his/her purchases in other categories. We’re trying to predict that consumer A will buy his/her first car (category 1) when he/she is a regular consumer of airline tickets (category 2).– Michel Savard, Practice Lead, Data Science at CRIM.

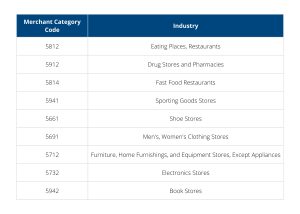

To make these inferences, CRIM’s experts carried out an impressive modelling of the purchasing habits of some one hundred million cardholders in Latin America and various merchant categories (255 MCC considered) to which are associated redeemable rewards. The result is a finer characterization of purchasing behavior and richer inference: the expected future value (EVA) of purchases made over a given period.

Examples of categories (MCC)

The purchase predictions generated by this modeling enable Mobi724 Global Solutions customers to make better marketing decisions and program campaigns according to location and context – at the airport, on a cab trip, at the chemist’s, in the grocery store, and so on. We can imagine a variety of use cases where CRIM’s data learning would be challenged. Experimentation on real campaigns would be the next step. To be continued…

1. Anonymous data provided by Mobi724 Global Solutions.

2. Merchant Category Code – indicating the type of merchant initiating a credit card transaction.

Sources:

https://www.consumer.equifax.ca/about-equifax/press-releases/-/blogs/les-depenses-par-cartes-de-credit-augmentent-alors-que-la-hausse-de-l-inflation-se-poursuit/

https://www.lesoleil.com/2022/03/22/les-cartes-avec-remises-en-argent-prennent-le-dessus-sur-les-programmes-de-points-f44501f6967970ff60c94ee5468f1d53

https://wallethub.com/edu/cc/merchant-category-code/25837